- Exploration status

- Hits: 4924

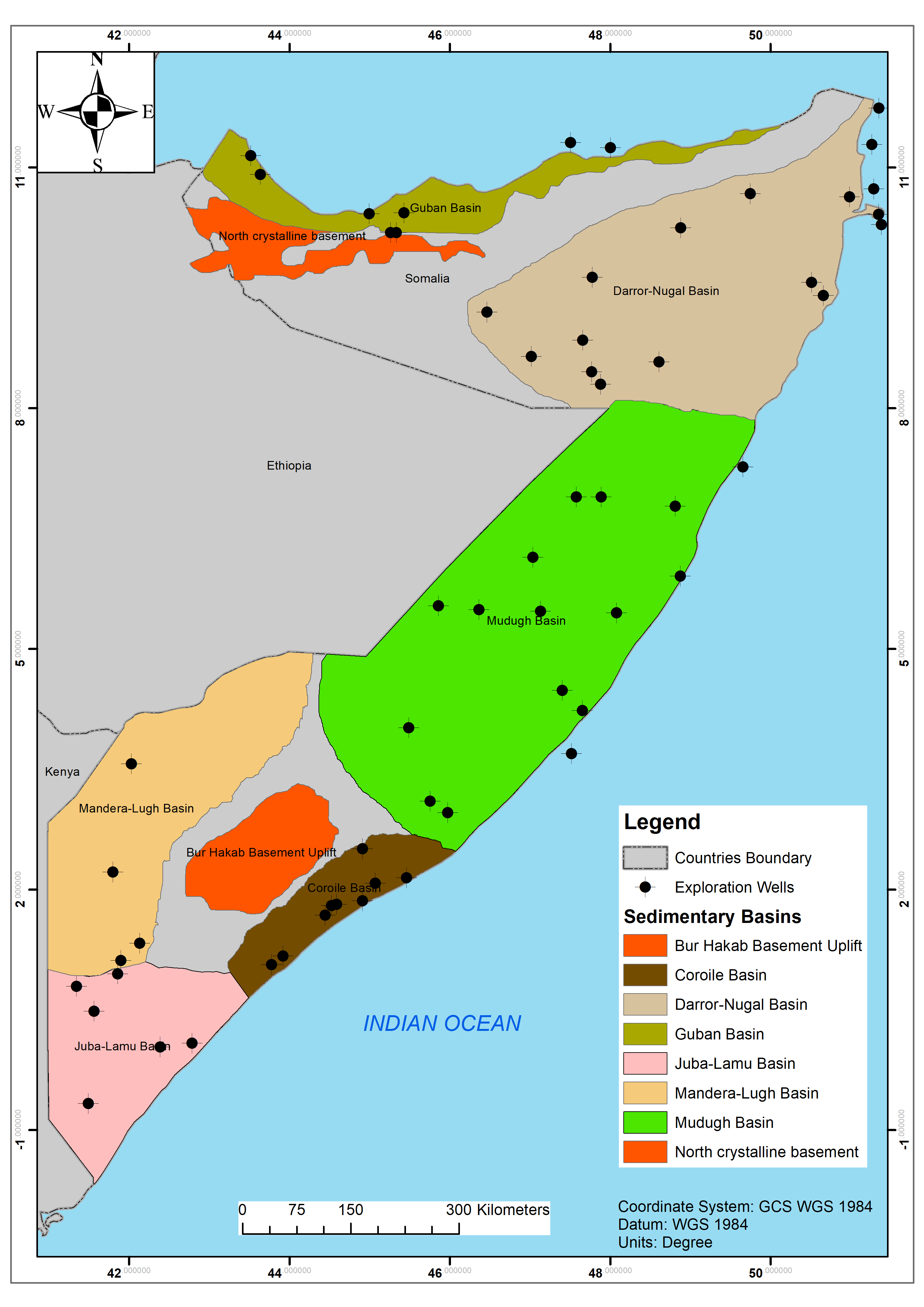

Uganda has 6 Sedimentary basins out of which the Albertine graben is the most explored. The graben forms the northern most part of the Western arm of the East African Rift System (EARS), stretching from the border with South Sudan in the North to Lake Edward in the South, a distance of over 500km. Other sedimentary basins are Hoima, Lake Kyoga, the Kadam-Moroto, Lake Wamala and Lake Victoria.

Within the Albertine graben, a total of about 6,000-line km of 2D seismic data and 2,000km2 of 3D seismic data has been acquired. In addition, since 2002, 160 exploration, appraisal and production wells have been drilled in the graben. To-date, 21 discoveries of oil and gas have been made in Uganda in excellent quality reservoir sands and many of the wells drilled have intersected significant net oil pay which is sometimes in excess of 30meters. The oil is generally light to medium gravity (API of approx. 15o to 33o) and sweet, with low Gas-Oil Ratio (GOR) and some associated wax. The discovered resources are currently estimated at a STOIIP of 6.5 billion barrels of oil and about 500Bcf of gas.

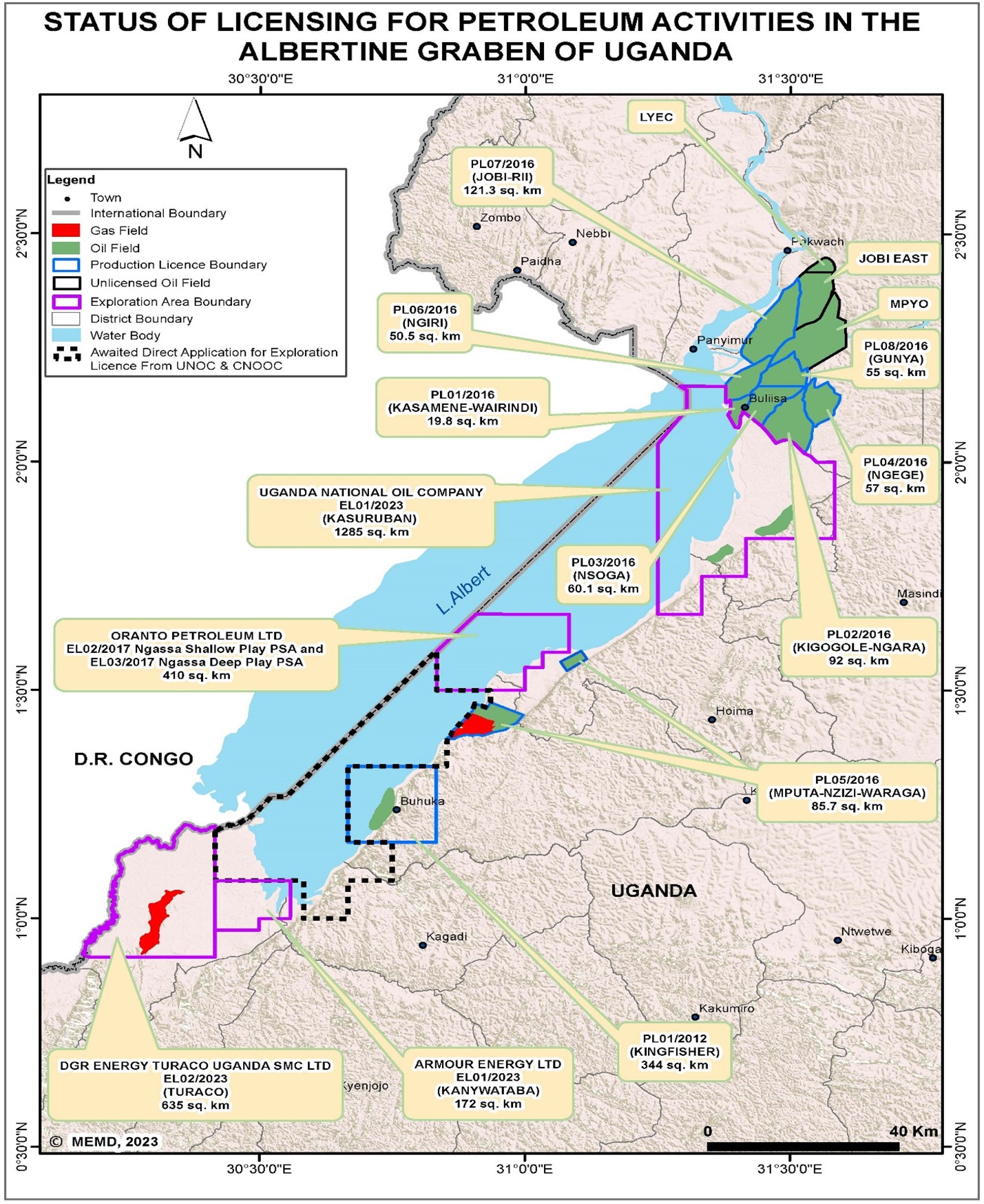

Approximately 15% of the petroliferous Albertine graben is currently licensed to International Oil Companies. Nine production licenses have been issued in this prolific area. These are; Kingfisher Development Area, Jobi-Rii, Gunya, Ngiri, Kasamene-Wairindi, Ngege, Nsoga, Kigogole-Ngara and Kaiso-Tonya (KT). Two companies that is TotalEnergies B.V (TotalEnergies) and CNOOC Uganda Limited (CNOOC) have been issued these licenses to develop and produce the fields.

The Government of Uganda further issued two more exploration licenses; to Uganda National Oil Company for the Kasurubani Block and DR Energy Turaco SMC for the Turaco Block in 2023. This followed the successful conclusion of the 2nd licensing round in Uganda that commenced in 2019. This licencing round was launched at the 9th East African Petroleum Conference and Exhibition 2019 (EAPCE’19) in Mombasa, Kenya.

The Government of Uganda has also commenced petroleum exploration in basins other than the Albertine Graben. This has started in Moroto-Kadam basin, North Eastern Uganda in the Karamoja region. This is majorly intended to increase the resource base of the country that will feed into this planned petroleum infrastructure. Currently, preliminary works have also commenced in the Lake Kyoga basin.

Current Developments in the Oil and Gas Sector

The Government of Uganda and together with the Upstream Joint Venture Partners are currently undertaking the developments necessary for the commercialization of the petroleum resources discovered in the Country.

Commercialization has been planned using two Upstream projects namely Tilenga and Kingfisher Projects, the Greenfield Oil Refinery and the East Africa Crude Oil Pipeline (EACOP). Government together with Oil companies has planned to drill over 400 wells during the development phase. These will include producers, injectors and observation wells. To date, a total of 39 development wells have been drilled in both Kingfisher and Tilenga projects.

In addition, commercialization is planned to include development of a 60,000bbl/day modular refinery and development of a heated and insulated buried crude oil export pipeline.

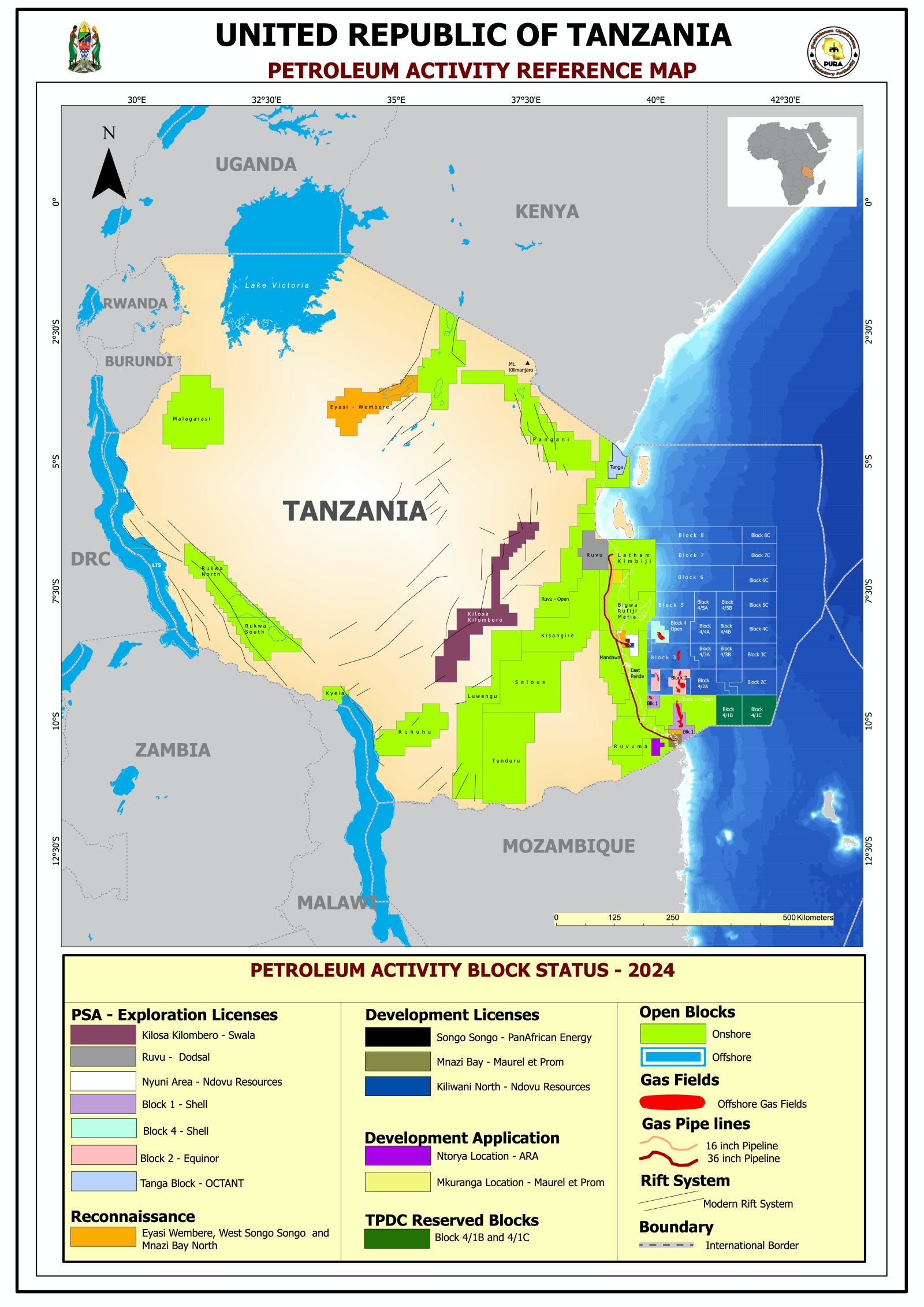

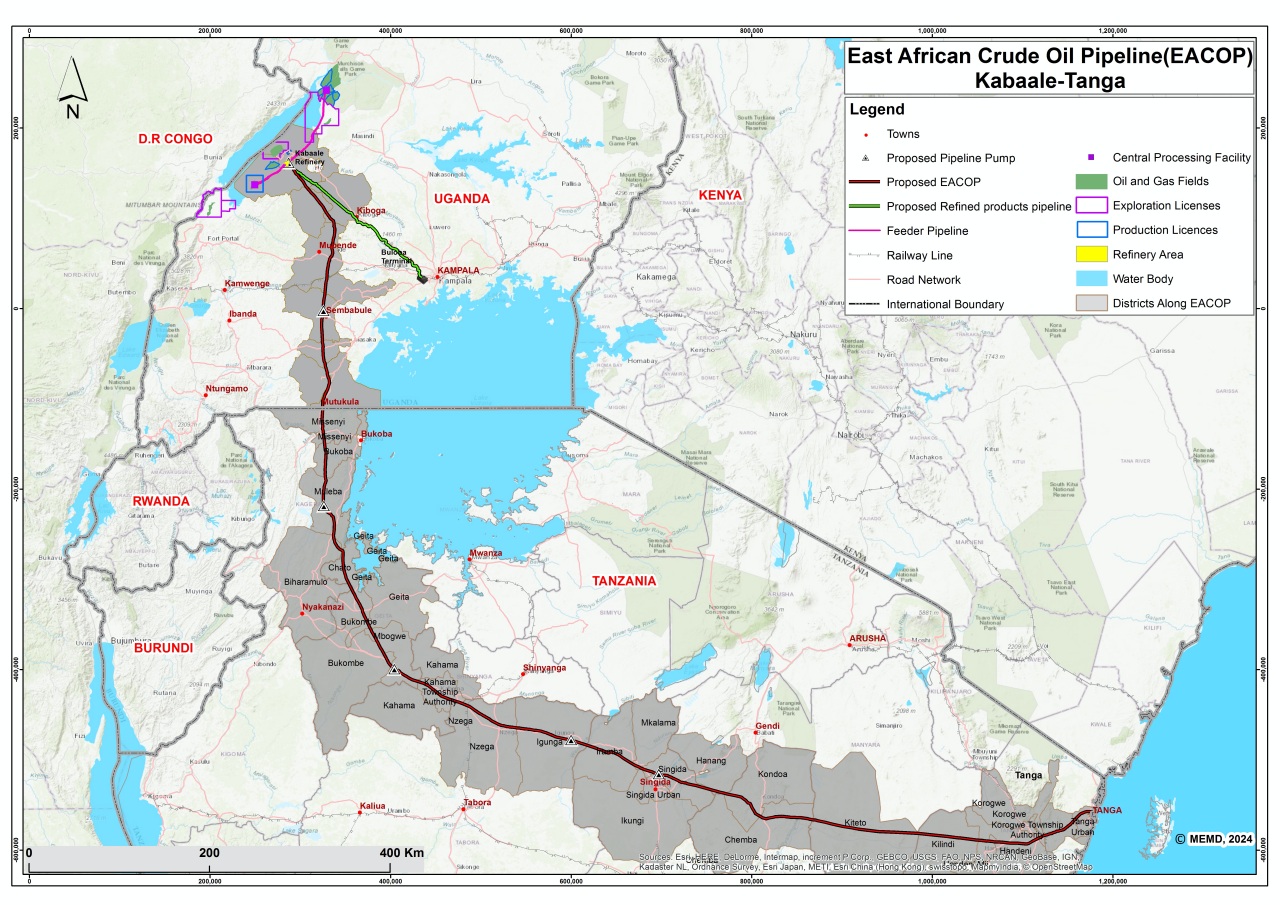

Following comprehensive studies, the Governments of Uganda and United Republic of Tanzania agreed to development of the East African Crude Oil Pipeline (EACOP). The export pipeline starts from Hoima district, Uganda and terminates at the Marine Storage Terminal (MST) at the Port of Tanga in the United Republic of Tanzania as indicated in the map below. It is from Tanga that the Crude Oil will access the international markets.

The two countries have since put in place the required legal and commercial framework for the development and operation of the pipeline. This includes but not limited to the Intergovernmental Agreement (IGA) for the development of the East African Crude Oil Pipeline (EACOP), and the Host Government Agreements (HGA) with the Project Developers, Transport and Tariff Agreement.

EACOP will traverse a distance of 1445km from Hoima in Uganda to Tanga in United Republic of Tanzania. The pipeline will be buried throughout the entire route, and longest heated pipeline in the world (Fig.5) Other pipelines are planned to be developed in the Country. These include; flowlines from fields to Central Processing Facilities (CPFs), feeder pipelines from the CPFs to collection hub, product pipeline from refinery to central market in Kampala and product pipelines linking Uganda to East African countries.

Following the announcement of the Final Investment Decision (FID) in February 2022, the EACOP Company has since received its construction license in January 2023 under the Petroleum (Refining, Conversation, Transmission and Midstream Storage) Act, 2013.

Post-licence, EACOP Company has issued contracts for construction and line pipes. Early Civil Works are underway in Uganda and Tanzania, Main Camps and Piping Yards, Marine Storage Terminal and the Coating Plant has been commissioned in March 2024. The detailed engineering for the pipeline is in advanced stages and compensation of the project affected persons for their land and properties in Uganda stands at over 95%.

Refinery Development

The Government of Uganda through the Ministry of Energy and Mineral Development is in discussions with potential investors.

Negotiation of the key commercial agreements between the Government and the Private investors is ongoing as well as the plans for the schedule of activities for the development of the pipeline.

Development of Supporting Infrastructure

Road Infrastructure: The Government is building over 700 km of roads in the Albertine Region, enhancing connectivity and living standards in Hoima, Buliisa, Nwoya Masindi, Fort Portal, Kibaale, Mubende, Ssembabule, and Mpigi. The roads have contributed to improved living standards, especially as affordable and accessible transport is a critical factor in production.

Kabaale Industrial Park: Spanning 29 sq. km in Kabaale, this park will include an oil refinery, Uganda's second international airport, a crude oil export hub, a logistics centre, and other oil and gas facilities.

Kabalega Airport: Currently 95% complete, this cargo airport will support oil and gas operations and later expand for passenger use, boosting tourism and western Uganda's agricultural exports.

The Downstream

Uganda predominantly imports its petroleum, with over 90% arriving through Kenya's Mombasa port, supplemented by imports via Tanzania's Dar-es-Salaam port. Our market-driven approach allows supply and demand to dictate pump prices naturally.

In 2023, Uganda's petroleum consumption reached 2.5 billion litres, The government policy is to ensure uninterrupted supply of petroleum products. Uganda plans to develop storage capacity of approximately 300 million liters at the Kampala Storage Terminal.

Liquified Petroleum Gas

Government has rolled out plans to promote the use of LPG at the household level. Some of the initiatives include making LPG readily available and affordable. In 2023, Government distributed 13,733 LPG Starter Kits in Kampala, Mukono, and Wakiso, and aims to reach 50,000 households across all cities in the 2024/2025 financial year.

With an annual growth rate of 9% in LPG usage, Government continues to support this green initiative by exempting LPG from taxes, encouraging wider adoption across Uganda.

In addition to the above efforts, the upstream projects will be producing LPG from the excess associated Gas to ensure conformity to our environment and climate standards and commitments